As the recent national elections were heating up and the debates were rocking the news cycle, a major tax fraud scandal almost escaped notice. At Weatherford International the tax fraud constitutes one of the larger fines in recent memory: $140 million for accounting fraud.

The company is Swiss-based Weatherford International, a major gas and oil conglomerate. They have offices throughout the world and thousands of employees. To understand this scandal, it is necessary to introduce the acronym “ETR,” or the effective tax rate. The ETR is the tax rate a corporation pays on its taxable income. If the company fraudulently (and purposely) plays with the tax accounting, they can inflate (or deflate) earnings.

The company is Swiss-based Weatherford International, a major gas and oil conglomerate. They have offices throughout the world and thousands of employees. To understand this scandal, it is necessary to introduce the acronym “ETR,” or the effective tax rate. The ETR is the tax rate a corporation pays on its taxable income. If the company fraudulently (and purposely) plays with the tax accounting, they can inflate (or deflate) earnings.

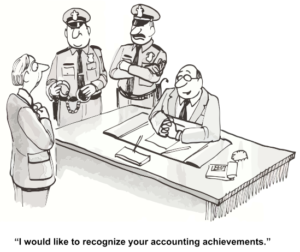

Two executives at Weatherford, the vice president of tax and the tax manager conspired to lower income tax provisions by $100 million per year over a four year period. In doing so, they inflated earnings by more than $900 million, which raised the stock price.

According to the SEC:

“Weatherford denied its investors accurate and reliable financial reporting by allowing two executives to choose their own numbers [italics are mine] when the actual financial results fell short of what was previously disclosed to analysts and the public.”

Therefore, if you were considering buying (or even selling) Weatherford International stock during that period, you were trading on fabricated information.

Weatherford International: Pressure from Where?

Accounting fraud is very difficult for the lay person to follow, especially when it applies to taxes. I would be very naïve indeed to suggest the misalignment between Weatherford’s tax accounting and its revenue accounting never occurs in any other companies.

However in Weatherford’s case, the intention to play it loose with the ETR was completely unethical. The word “intention” is key, for not only were the tax rates altered to make the stock prices bring into line with what the analysts had projected, but the higher stock prices enabled Weatherford to acquire other companies more easily. Therefore, the fraud affected at least two areas of transactions: stock prices and buying power.

In addition to the $140 million the company must pay, one of the executives must personally pay about $335,000 in fines, while the manager must pay a $30,000 fine.

This brings up the ethical implications of the scandal. It is a multi-level discussion.

It is very difficult to imagine that in a worldwide company having revenues of $13 billion and 30,000 employees, that the only people who had any knowledge of the fraud were two employees in the tax department. It defies logic that the CFO, for example had no idea of what was going on, and going in the other direction, that no accounting department employees under the tax manager could understand the cover-up.

There had to have been pressures to falsely report. Where it came from is not within the scope of this post to say, but it is easy to see why.

I am also somewhat interested, from an ethical perspective, to explore why the vice-president of taxes paid out more than 10 times the fine of the tax manager. It almost suggests coercion where the tax manager, afraid of losing his job, went along with the pressures above him.

It appears to me that these two executives might have taken a major hit on behalf of the company. If either of these executives were CPAs or lawyers, I would also imagine they are in danger of losing certifications and licensure.

Was it worth it?

Ethical stands are hard to make. No one rewards the whistle-blower. We can be fooled into believing that if we don’t go along with a fraud, then our organization will turn on us. One factor we never take into consideration is that if we commit fraud, will our organizations support us? No, almost never. Despite the temptations, the better choice is to walk away.

Easier said than done? Perhaps. Great salaries and benefits are hard to ignore, but in the overall scheme of things our ethics ultimately define who we are. The choices we make are how our lives are often measured. Years from now, the tax men who committed the fraud might very well look back and ask if it was worth it. Their answer will be reflected in the mirror of their choices.

YOUR COMMENTS ARE WELCOME!